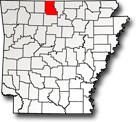

Assessor

Tonya Eppes

County Assessor

Physical Address:

300 E. Old Main St.

Yellville, AR 72687

Mailing Address:

P.O. Box 532

Yellville, AR 72687

County Assessor

The Assessor's Office maintains current appraisal and assessment records, makes changes in valuations as they occur, stays abreast of property transactions within the county and keeps a file on properties updated throughout the year. Personal property assessments must be made by May 31 of each year.

County Services Offered

ELECTED COUNTY SURVEYOR - It shall be the duty of the county surveyor to execute all orders directed to him or her by any court of record for surveying or resurveying any tract of land, the title of which is in dispute or in litigation before the court, and to obey all orders of survey for the partition of real estate, and also to accompany viewers and reviewers of roads for the purpose of running and measuring any proposed road, whenever required by the viewers or reviewers. Ark. Code Ann.§ 14-15-702

Keith A. Sullivan, Marion County Surveyor

3248 MC 6075 Yellville, AR 72687.

Phone: (870) 449-2499

Cell (870) 405-4488

FAQs

How do I apply for a building permit or get electric to property I am going to build on?

You may contact the Marion County Assessor's Office from 8 a.m. to 4:30 p.m. Monday through Friday in the Marion County Courthouse, 300 E. Old Main St., P. O. Box 532, Yellville, AR 72687, or call 870-449-4113 or email assessor.marioncounty@gmail.com.

Procedure for Obtaining and Development and Occupancy Permit can be printed from this downloadable application.

How do I apply for an E-911 (street) address or apply for a private road name?

You may contact the E-911 Addressing & Mapping Office from 8 a.m. to 4:30 p.m. Monday through Friday in the Marion County Emergency Command Center, 491 Hwy. 62 W., Yellville, AR 72687, or call 870-449-7567 or email addressing@marioncounty.ar.gov.

Assessing Personal Property

How to assess: In Marion County, We request that you assess for the first time by coming to the office in person, Subsequent assessments may be made:

- In Person: Marion County Courthouse, 300 E. Old Main St. Yellville, AR

- By Telephone: (870) 449-4113

- By Email: assessor.marioncounty@gmail.com

- Online: www.countyservice.net

- By mail: PO Box 532, Yellville, AR 72687

When to Assess

In Arkansas, your Personal Property must be assessed each year between January 1st and May 31st. You do not receive a reminder; it is your responsibility to make your assessment each year in a timely manner. Property owned and housed in Marion County prior to May 31st must be assessed by the deadline to avoid a 10% penalty. Vehicles purchased in May have 30 days from the date of sale to assess without penalty. As residents buy, sell and trade vehicles; or move into, out of, or within the county; they need to notify the Assessor's office of these changes as they occur. It is also important to note whether your School District has changes if your address changes.

What to Assess

Arkansas law requires that personal property must be assessed.

This includes: Automobiles, Motorcycles, Recreational Vehicles, Boats, Motors, Trailers, Tractors, Livestock, Farm Equipment, etc.

When adding vehicles, please have make, model and vehicle identification number (VIN)

For real estate Records online- https://www.actdatascout.com/RealProperty/Arkansas/Marion